Experience you can trust

Generational is a leading, full-service M&A advisory firm for the middle-market

With over 1,700 completed transactions, our comprehensive process helps business owners successfully grow and exit their business for maximum value. Our approach safeguards confidentiality while simultaneously ensuring broad market exposure, significantly increasing the likelihood of attracting the right buyers and driving competitive interest. Raise your expectations.

The Generational Advantage

Our experienced professionals advise and guide you through the entire M&A process. We help you identify and avoid potential obstacles that can cost you both time and money.

About Us

Executive Conferences

This impactful, educational conference offers business owners a master’s level, crash course on M&A. We have helped prepare over 115,000 business owners to date.

Learn More

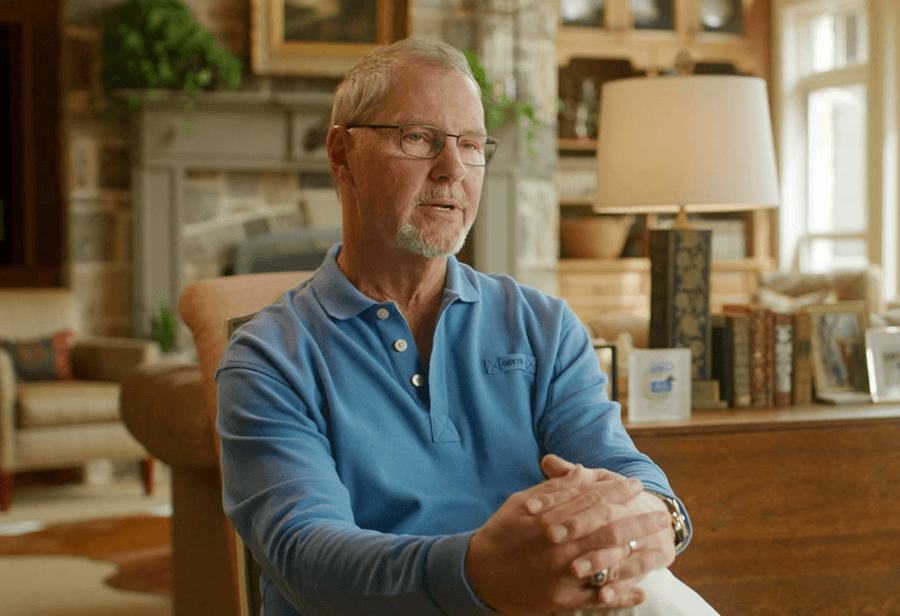

Client Testimonials

Business owner, Alan Terry, discusses his life-changing experience with the Generational team and how their expertise rescued a deal and made the exit a success.

Watch this Story

M&A Process Specialists

Backed by decades of industry-leading experience, Generational has become one of North America’s premier M&A firms by consistently delivering exceptional outcomes for privately held business owners. Our proprietary M&A process has been refined over hundreds of engagements to strategically protect, prepare, and guide clients through every phase of their exit — all with the singular goal of achieving maximum value.

At Generational, we empower business owners to shape their future through customized, strategic exit plans. Our seasoned M&A professionals specialize in maximizing business valuation and ensuring privately held companies sell at the right time for the best possible price.

From full sales to partial equity deals, we guide you through every option, helping you secure the ideal transaction to achieve your goals.

At Generational, we believe selling a business is more than a transaction — it’s a defining moment. With decades of experience and over $9 billion in transactions, our vetted M&A professionals help business owners boost valuation and execute strategic exits with confidence.

We guide clients through every step, ensuring the best outcome when the time is right. You’ve built something remarkable—let us help you realize its full value.

16,605+

Potential buyers in our national database

57,328+

Executive Conference attendees

683+

Successful transactions

Complimentary M&A Master Class

How and When to Sell Your Business for Maximum Profit

This complimentary conference provides essential knowledge on successful exit and growth strategies, including business valuation and value enhancement tactics to determine how and when to sell a business for optimal value.

More Conference Details

Get your business exit-ready

Locate an Executive Conference near you.

Your nearest conferences are:

There are currently no upcoming conferences matching your search.

Please register your interests in future events.

Unable to Attend?

Not a problem, register your interest and we will let you know when an executive conference is next in your area.

Explore all your options with the leaders in M&A strategy

We recommend every business, large or small, develop a strategic, customized M&A roadmap. Without one, you risk losing a lot of time and a lot of money.

Complete the form or call and speak with a Senior Business Advisor today.

+1-972-232-1121