Premier business services that accelerate success.

We are a leading, full-service business advisory firm providing M&A Services, Growth Consulting, Wealth Management and Digital Solutions for the middle-market.

The Generational suite of advisory services includes Strategic Growth Consulting, Exit Planning Services, Business Valuation, Value Enhancement Strategies, M&A Services, and Wealth Management. Our comprehensive process helps business owners successfully grow and exit their business for maximum value. Regardless of where you are on your journey, Generational offers a wide range of business services that will help you meet your goals.

We are M&A process specialists

The Generational M&A process is designed to protect, prepare and guide clients along the path to exiting for maximum value. It also ensures client confidentiality while achieving maximum exposure, increasing the likelihood of attracting the right buyers.

M&A Services

When you work with Generational, growing and selling a business means owning your future. Our experienced M&A professionals help privately held business owners build their business valuation and exit their company at the right time for the optimal price. How and when you sell your business determines your legacy – you owe it to yourself to be ready for when that day comes.

Growth Consulting

Generational Consulting Group consists of experts that develop and implement strategic growth and value creation plans for privately held companies. We offer solutions that help you accelerate your growth, increase your value, and prepare you for an eventual successful exit.

Wealth Advisory

Anyone can leave an inheritance, Generational Wealth Advisors helps you leave a legacy.

The Generational Wealth Advisors team carefully considers the numerous and diverse areas of each client’s financial picture. Through a consultative and collaborative approach, we discover and evaluate each client’s specific needs and then develop, implement, and monitor a plan designed to achieve their goals.

Digital Solutions

Our digital consulting firm, Precocity, is focused on strategic transformation, data, design and technology. Many visionaries and companies have disruptive ideas, but don’t know how to make them a reality. We bring those ideas to life. We create meaningful solutions.

Business Intelligence

Our deal teams have years of experience in helping business owners across a broad spectrum of industry sectors. We understand the unique nuances of your industry and we combine that knowledge with a proven process that delivers results for our clients.

Our Industry Expertise

We guide clients through the entire M&A process, including valuation, market readiness, due diligence, deal structure and negotiations. Our deal team has years of experience helping business owners across a broad spectrum of industry sectors.

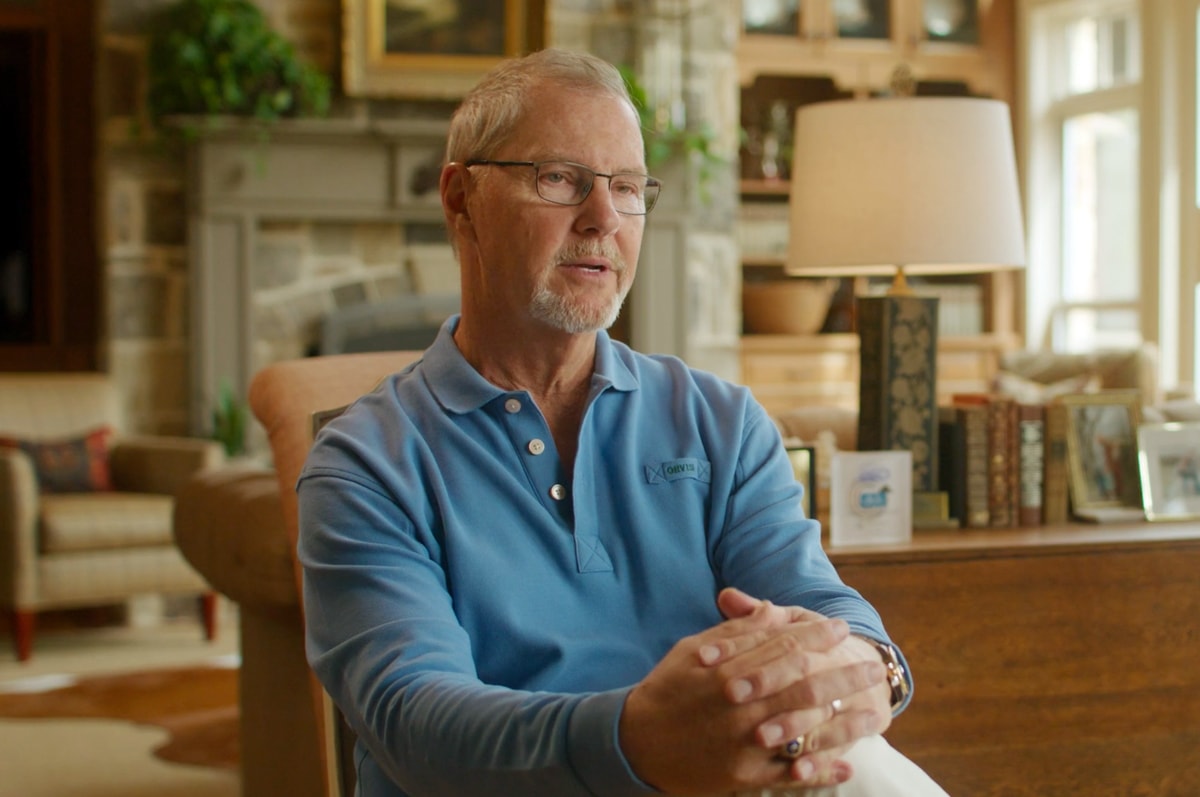

A Generational Client Story

Preparation Made the Difference

When Dick Richardson decided it was time to exit his business, he reached out to the experienced team at Generational to help him get his business exit-ready. The strategies he learned and the guidance he received perfectly positioned his company for the market.

View all Testimonials

GROW SMART. SELL SMART.

Growth and Exit Strategies Conferences

This complimentary conference gives you must-have knowledge on successful growth and exit strategies, including business valuation and value enhancement tactics to determine how and when to sell a business for optimal value.

More Conference Details

Get your business exit-ready

Locate a Growth and Exit Strategies Conference near you.

Your nearest conferences are:

There are currently no upcoming conferences matching your search.

Please register your interests in future events.

Unable to Attend?

Not a problem, register your interest and we will let you know when an executive conference is next in your area.

We Focus on Your Goals

Wealth Advisory that Creates a Successful Legacy

Our customized wealth management approach addresses each client’s unique vision.

Combining your goals defined in your personal financial plan and our expertise in the investment space, we work alongside you to design a wealth management solution that speaks directly to you and your legacy.

Learn More

Successful Transactions

We invite you to view successful transactions in your industry. Reading these case stories are a great way to learn exactly what professional M&A advisory services deliver.

View Transactions

Growth and Exit Conference

This impactful, educational conference offers business owners a master’s level, crash course on M&A. We have helped prepare over 110,000 business owners to date.

Learn More

Trust the Process

Business owner, Alan Terry, discusses his experience with the Generational team and how their expertise rescued a deal and made the exit a success.

Watch this Story

Latest News

We regularly create updates that educate business owners on the many aspects of selling a business at the right time for the optimal value. We invite you to take an in-depth look at all the factors affecting mergers and acquisitions to help you decide when to value your business, sell or invest at the right time.